If you are a senior and you are deciding whether to get a home equity line of credit (HELOC) or a reverse mortgage, you need to answer one question. Do you want to stay in your current home no matter what? If the answer is yes, then a reverse mortgage might be in your future.

The problem with HELOCs are that the borrowing limits are set based on the income at the time of application. Unless you set this up before you retire, chances are your limit will not be large enough to last. This is why I like to advocate for getting a HELOC before you retire. This way you have an emergency fund should you need it. They do not charge interest if you don’t use it. Applying when you do need the money will be too late when you don’t have a job.

If your HELOC limit is large enough to last you, then the HELOC is the better choice because the rate is always lower. But you need to make sure, because once you use up your HELOC limit and you cannot cover the interest payments, you will need to sell your home. Typically, you cannot switch from a HELOC to a reverse mortgage. So you need to figure out whether the HELOC limit is high enough before committing to it.

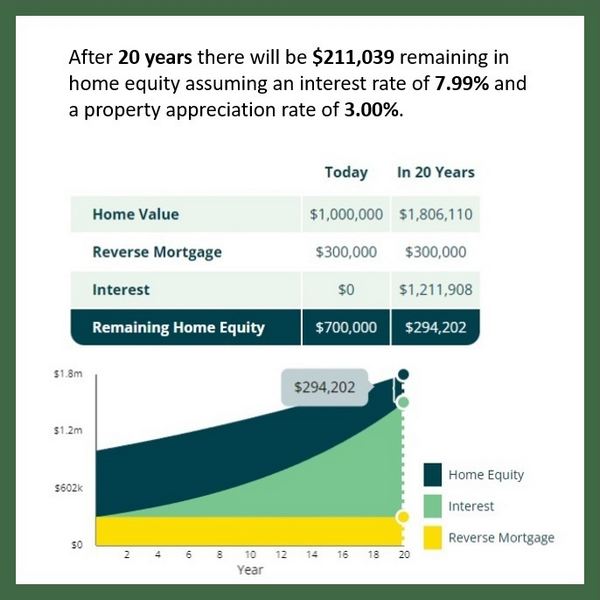

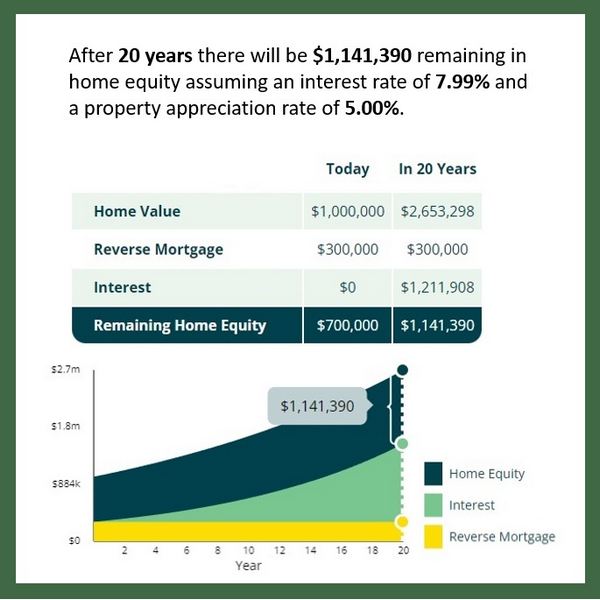

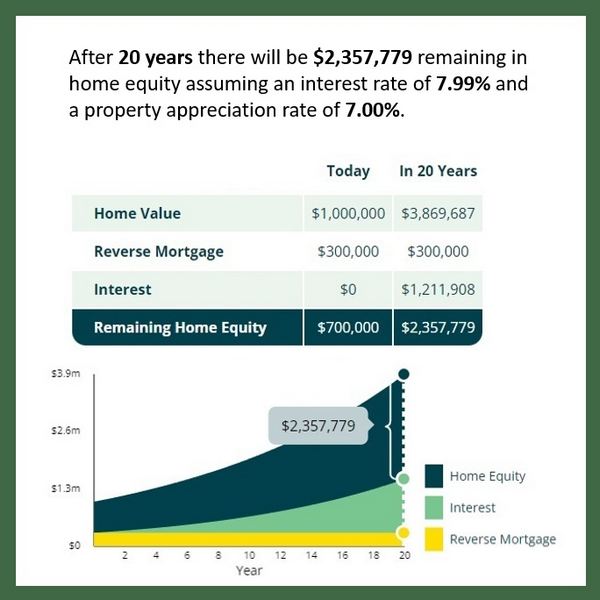

The beauty of the reverse mortgage is that it never runs out. The lender typically maxes out the loan at 55% of the value of the home. Because usually the total value of your home appreciates more than the loan, there will be more equity left at the end. Of course, this depends on the rate of interest, the size of the loan, the length of the loan and the appreciation rate for the property. But for a property in Metro Vancouver, I would say your chances are great that you will have equity left. To illustrate this, let’s look at someone borrowing $300,000 at age 65 on a $1,000,000 home. In the worst 10 year period, Vancouver real estate appreciated about 3% a year. Currently, the interest rate is on the high side as these mortgages are also affected by the increases of prime rate. For a 5 year fixed, it is at 7.99%. I would expect the rate to fall by the end of the 5 years, but let’s assume it goes to 8.34% for another 15 years. What would that look like with 3% appreciation?

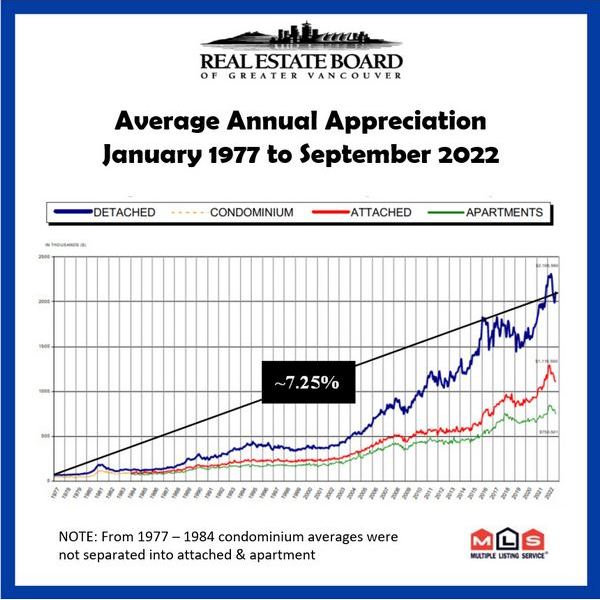

Well, at the end of 20 years, there will still be $294,202 left in equity with such a conservative estimation. Historically speaking over the last 45 years, real estate in Vancouver has gone up an average of 7.25% per year. So what would the situation look like if we replace the appreciation rate with 5% or 7%? With a 5% appreciation rate, there will be $1,141,390 left in equity. And with 7%, $2,357,779. Of course, if you live in remote areas of the province, the appreciation rate will be lower and you’ll need to consider that. But note even if the loan exceeds the value of the home, you will not have to move. The lender will take the loss at the time you need to move to a care home or when you pass away.

Reverse mortgage is a good solution when you have no other resources. If you don’t have relatives or children to help you out, then using your home to make your retirement more enjoyable is the least you can do for yourself. Just this week in the news, Vancouver city hall erroneously auctioned off someone’s house to collect on unpaid property taxes. Later, they found out that the owner had died 6 years ago. The house has no mortgage and he has no heirs. So everything will go to the province. I hope his last years were great and lived without financial constraints. I have heard of seniors living in squalor because of a small pension all the while living in a paid off house worth millions. Currently, the best products are only available through mortgage brokers.

For more information go to our FAQ page: Reverse Mortgages | Alternative Lending Canada