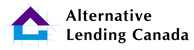

Canadian seniors now owe 6.7 billion in reverse mortgage debt. And it is rising quickly. A reverse mortgage is a loan you take out against your home where you don’t need to make monthly payments. The accrued interest is added to your principal amount. This along with the fact that the interest rate is higher than your typical mortgage or home equity line of credit (HELOC) makes this type of loan more of a last resort as it will eat away at the equity in your home faster. Though you do have the option of paying the interest and preventing the loan from increasing in size. These loans are geared towards the elderly as it does not require proof of income and generally you need to be 55 or older to get one.

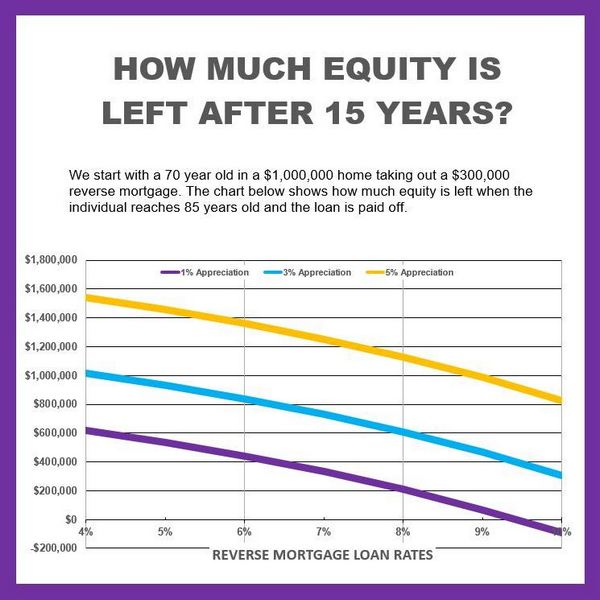

Make sure you do the math first before proceeding. You need to have your mortgage broker provide projections at various interest rates and home appreciation rates. But this is not a fail-proof strategy. A projection made today and a project made a year ago would be very different. There is definitely risk involved but I would say no more than variable rate mortgages or HELOCs. To be fair, we are in an unprecedented time but no one expects the interest rate to stay this high forever. Nevertheless, if you get into a reverse mortgage now, you should consider the high interest rate carefully, especially if you don’t live in Metro Vancouver.

Typically, if the population don’t change the price of houses should keep up with inflation. When population increases, the extra demand should drive prices higher. And the reverse is also true. So if you are living in Vancouver and you know a good chunk of the annual 500,000 immigrants will be competing for a home, I would say you are relatively safe that the long term growth would beat inflation. But if you are living in a rural area in BC where they just shut down a mill, your property might be falling in value. One good thing about reverse mortgages in Canada is that most will guarantee that you will not pay more than the value of your home and they will never kick you out of your home. So if in the unfortunate situation where you owe more than the value of your house, the lender will eat the loss.

Reverse mortgage is more expensive and shouldn’t be the first choice but if you don’t have relatives that can help you financially, why not use the equity to live better. I understand that many people who are currently elderly lived through tough times. They know of poverty and hunger. So they tend to save and do not know how to spend. I have an elderly friend who suddenly passed away recently. Always a saver, he was very well off financially but he never spent his money. He bought very old used cars and still had a CRT TV in the living room. Now all his money will be going to relatives he hasn’t seen in decades. Don’t be like my friend.

I have included a chart to illustrate how much equity is left after 15 years depending on the rate of the loan and how fast the property appreciates. This is based on a 70 year old who has a $1,000,000 home and decided to take out a $300,000 reverse mortgage. For example, if the property was appreciating at 3% per year and the interest rate was 7%, after 15 years there would be over $300,000 in equity after the loan is paid off. You can see if the property appreciates at 1% per year, the loan would be greater than the value of the home if the interest rate was 10% or higher. However, if the home is in an area where appreciation is higher, like 3%, negative equity will not be reached even if the rate of the loan was 10%. If you want more information you can contact me or you can click the FAQ link HERE.