When you’re on the cusp of securing a mortgage, lenders may tempt you with a last-ditch offer: a chance to safeguard your family’s future with mortgage “life insurance.” It’s prudent to protect your loved ones, certainly – yet there’s a more cost-effective and comprehensive strategy than the insurance option from your bank.

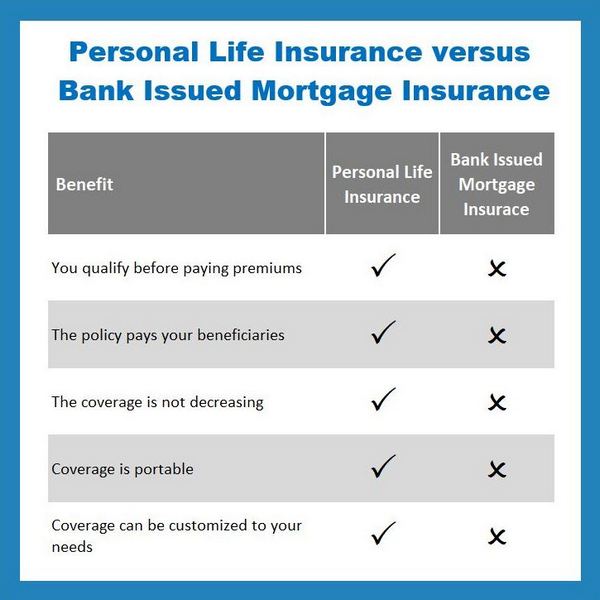

This product that banks promote is technically creditor’s insurance. Rather than a safety net for your family, it’s actually designed to repay the bank should you meet an untimely end. It’s a stark contrast to the peace of mind that comes with knowing your family will directly benefit from the policy. Furthermore, creditor’s insurance is evaluated at the time of claim, which means the certainty of coverage remains unknown until a claim is made – a risky prospect when your family’s welfare is on the line.

In contrast, a standard life insurance policy acquired through an insurance agent is underwritten at the outset. Coverage is confirmed, and no premiums are collected until this assurance is in place.

Bank-provided policies also come with strings attached: they’re only valid as long as your mortgage is with that institution. Should you transfer your mortgage to another bank, you must endure the application process again, likely facing increasing premiums with each move. A personal life insurance policy, however, is portable and independent of your mortgage provider, offering uninterrupted coverage without the need to reapply.

Despite these advantages, personal life insurance policies often come with lower premiums than those offered by banks. If you’ve already opted for creditor’s insurance, don’t despair – it’s not too late. Provided you’re in good health, you can switch to a more beneficial policy. I’m here to help. Reach out, and I’ll provide you with a competitive quote that can offer you and your family true financial security.