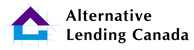

Starting June 25, 2024, the Federal Budget brings changes to capital gains taxes. Previously, when selling stocks or rental properties for profit, 50% of that profit was taxable. Now, the inclusion rate jumps to 66.7% from 50%.

The good part of this bad news is that the first $250,000 per year of capital gains maintain it’s 50% inclusion rate for personal taxes. Also the selling of your principal residence will continue to be exempt from capital gains taxation. However, for investments within a corporation, every dollar of capital gains is subject to the new inclusion rate.

This change might not sit well with small business owners who rely on investing retained earnings within their corporations for their retirement plans. In British Columbia, capital gains inside a corporation are already taxed at 50.67%. With the inclusion rate increasing to 66.7%, the capital gain tax payable will be 33% higher, slowing down investment growth. This makes participating whole life insurance even more favorable because investments inside the policy do not get taxed. All small corporate business owners should investigate this alternative.

Below are a couple of tables that compares the extra taxes you may be paying if you sold something for a profit inside and outside of a corporation.

Before making any hasty decisions to sell your property ahead of the deadline, consult your accountant. The large capital gains from such sale may trigger a little mentioned alternative minimum tax which may cause you to pay the government even more.

For more information, you can go to the government webpage at : https://www.canada.ca/en/department-finance/news/2024/04/tax-fairness-for-every-generation.html