Happy to report that we are certified for reverse mortgages through CHIP. It is another tool for alternative lending that the banks do not have. This product is not for everybody but it is a perfect solution for certain seniors.

You need to talk to someone familiar with this product to make an intelligent decision on it. A majority of the information on the internet refers to the products in the United States. It is not the same here. It is much better in Canada.

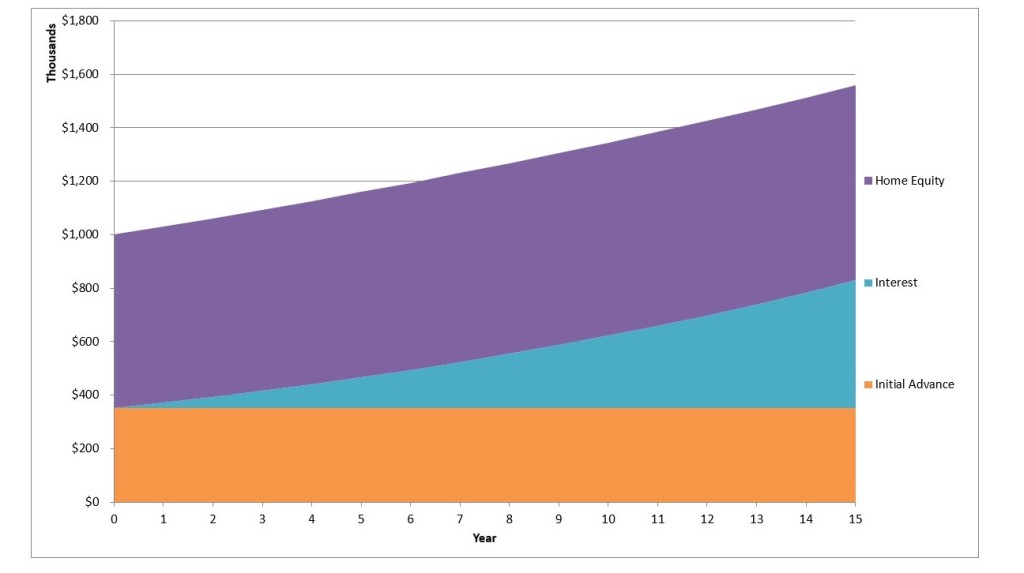

We were not quite onboard with this product at first until we saw this graph.

Basically, it shows a 1 million dollar house with a $350,000 reverse mortgage (orange) at 5.84% interest rate. The interest accumulated is in blue. And the equity the owner has is in purple. So, after 15 years of not paying a penny, there is still $728,000 in home equity left. And this is assuming an appreciation rate of 3%. Canadian house appreciation over the last 35 years averages 4.89%. It is 6% over the last 15 years. And this is for Canada, not Vancouver which would be a lot higher.

Even under this conservative estimation, the owner will still have a large portion of home equity left.

This is definitely a viable solution for someone who wants to stay in their house but have limited income.

Give us a call to find out the pros and cons of this program and whether there is a better solution for you.

Alternative lending.ca help people by providing options beyond regular bank lending. We operate out of Vancouver, BC, but can assist people in all of BC and selected locations in Alberta, Manitoba, Saskatchewan and Ontario.