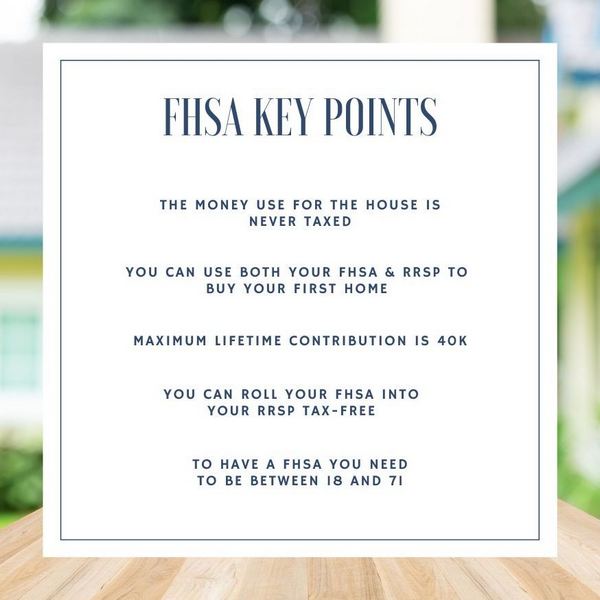

The First Home Savings Account (FHSA) is a new account the Federal Government created to help people save money to buy a home. It is better than the RRSP and the TFSA, because that money is NEVER taxed. And the growth is never taxed. With the RRSP, every dollar withdrawn is taxed as income. And the money inside your TFSA has already been taxed.

Because money not used for the purpose of buying a home can be rolled over to the RRSP tax-free, people who don’t plan on buying a home can use this as an extension to the RRSP.

Even though the FHSA is better than the RRSP, if you have the money you can contribute to both. And you can withdraw money from both accounts to help you buy your first home. With an RRSP, this withdrawal is part of the Home Buyers Plan. This means the maximum is $35,000 and you need to pay it back over 15 years. FHSA has no withdrawal limit and you never need to pay it back.

You need to be at least 18 before you can open a FHSA. You also need to be a resident of Canada and a first-time home buyer. You are considered a first-time home buyer if you have not lived in a home owned by you or your spouse in the current year and the previous 4 calendar years. This means you are considered a first time home buyer even if you own a rental property but are living with your parents. Or if you owned a place more than 4 years ago.

You are allowed to put in a maximum of 8K each year and build up to a maximum of 40K. And you can put that money into all the same investments that you can with an RRSP or TFSA. You need to open your account to start to accumulate contribution room; however, you are only allowed to carryover a maximum of $8000 from year to year if you do not use up your contribution room. It is not like an RRSP where you carry over everything you do not use. Here you only can carry over $8000 maximum.

If you withdrew money to buy a home, the FHSA has to be closed. If you don’t buy your house within 15 years from the start of your FHSA or if you are 71 years of age, you also have to close the account. You have a choice of rolling it over to your RRSP tax-free or if you are 71, into your RRIF tax-free.

This is a great account. If you have the possibility of buying a place within 15 years, open an account now. Or even if your financial plan can benefit from a larger RRSP. But remember if you have a large RRSP, at death it is likely that only half your RRSP will go to your beneficiary because half of it will be taxed away.