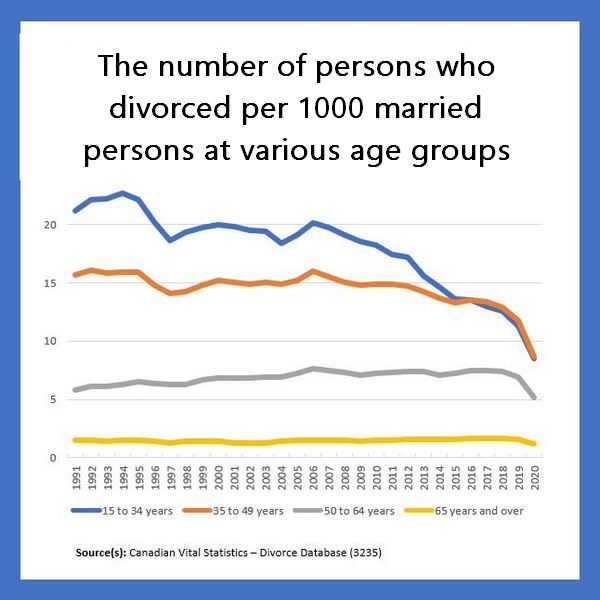

In recent years, I have heard that grey divorces, divorces among older adults, have been on the rise. But when I look at the stats, I do not find this to be the case. In fact, in Canada the divorce rate has been going down. Yay! And if you look at the divorce rate for 65 years and over, it has been steady for 3 decades. Interestingly, the phenomenon of increasing grey divorces is more characteristic of the United States, where, from 1990 to 2010, the divorce rate among those aged 65 and older actually doubled! This situation shows how easy it is to assume that trends in the U.S. apply to Canada as well.

I wonder if this is why in a recent presentation, reverse mortgage solutions for grey divorces were discussed. It presented a 72 year old couple with a detached home worth $1,000,000. Upon divorce each was able to purchase something worth $800,000 or one of the spouses stayed in the 1M home and the other got a new home for $800,000. While reverse mortgages do not require monthly payments and have very little requirements in terms of qualification outside of the equity you have on the property, they have higher rates. This does not make sense for everyone. In fact, it doesn’t make sense for a lot of people. Individual circumstances and goals must be reviewed. However, it does provide the option to stay in your own home while you age. And you don’t have to worry about renovictions and rising rents.

For more information you can click the following image. If you know of anyone interested in looking into a reverse mortgage, please pass this newsletter along. It is important to get proper counselling before committing to a reverse mortgage!