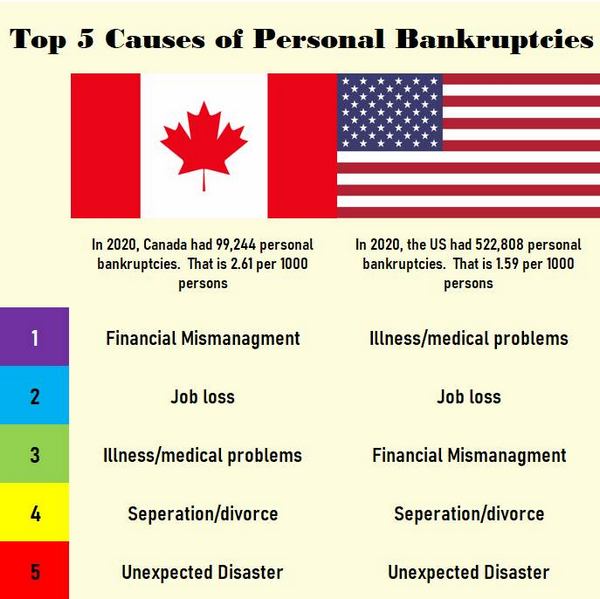

There have been studies that say around 60% of US personal bankruptcies are due to illness or medical problems. I feel so lucky to live in Canada where we have a much better medical system. In 2020, the bankruptcy rate actually dropped due to all the covid stimulus. For example in Canada in 2019, there were around 140,000 bankruptcies while in 2020, there were only 99,000. Now with the covid stimulus pretty much over, a rising interest rate environment and talk of a recession, bankruptcies will pick up.

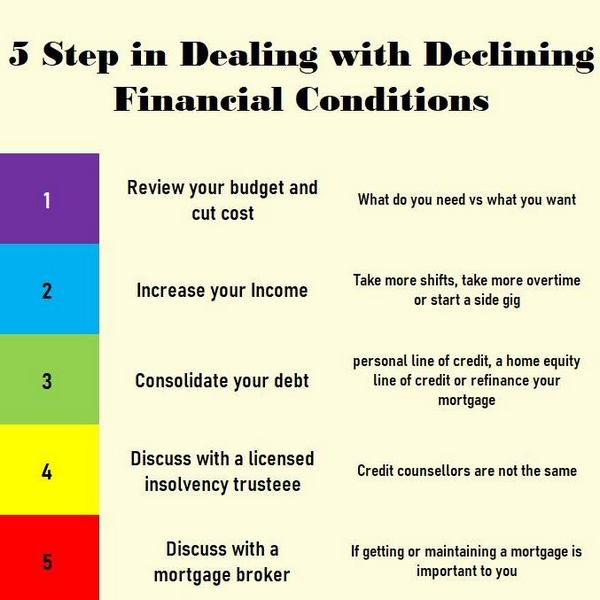

Luckily for some, their financial woes will not end in bankruptcies. The best defense is to plan ahead. Putting your head in the sand and hoping for the best is not a strategy. There are strategies to employ to improve your finances. The first step is to look at where you are spending your money and where you can cut back. Then see if there are extra sources of income such as taking more overtime, more shifts or starting up a side gig. If you are starting to not pay off your credit card balance monthly, look into consolidating your loan with a personal line of credit, a home equity line of credit or by refinancing your mortgage. Investigate these options before you start missing payments. A mortgage broker may be helpful in securing a HELOC or refinancing your mortgage.

Taking these steps will prevent your credit from being damaged. It can be costly, if your mortgage is up for renewal. Not all lenders have time to check your credit before the renewal but I have seen it happen. Then it is either a much higher rate and worse they will not renew your mortgage.

The last option would be to talk to a licensed insolvency trustee. Like I mentioned in a previous article, insolvency trustees are government licensed and you are more likely to get competent quality advice than a credit counsellor. However, if you currently have a mortgage and being able to keep your house or being able to buy one in the near future is important, I would recommend talking to me as well.

Pass this article along to someone you think needs to read it. Maybe we can help someone together.