Last month, the government announced significant mortgage reforms, offering some relief and new opportunities for homebuyers. Starting December 15, 2024, two major changes will take effect:

1) 30-year amortization will be available for first-time homebuyers and all purchasers of new builds.

2) The price cap for insured mortgages will increase from $1 million to $1.5 million.

But what do these changes mean for the market, and more importantly, for you?

The Impact of 30-Year Amortization

There are two possible benefits of switching from a 25-year to a 30-year amortization:

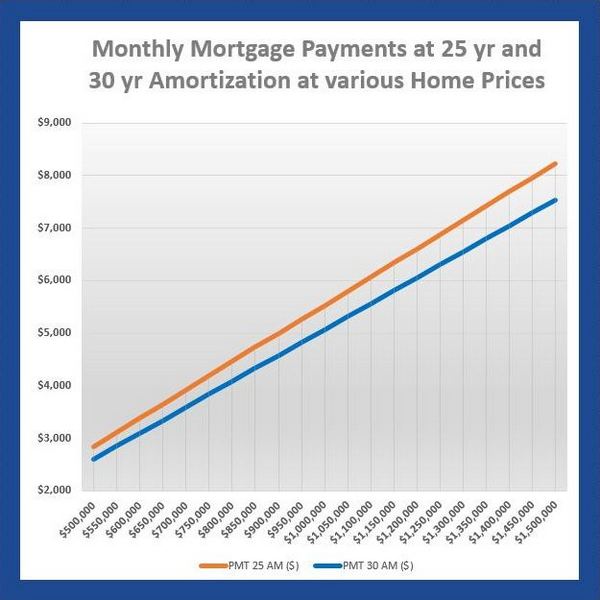

1) Lower monthly payments: Spreading the mortgage over an additional five years reduces the monthly cost.

For example: At a home price of $500,000, the monthly payment is around $240/month lower for the 30 year amortization is around $240. When the home price is $1.5 million, the difference increases to $690.

While these savings are significant, remember that a longer amortization means it will take five more years to pay off your mortgage—assuming interest rates stay the same.

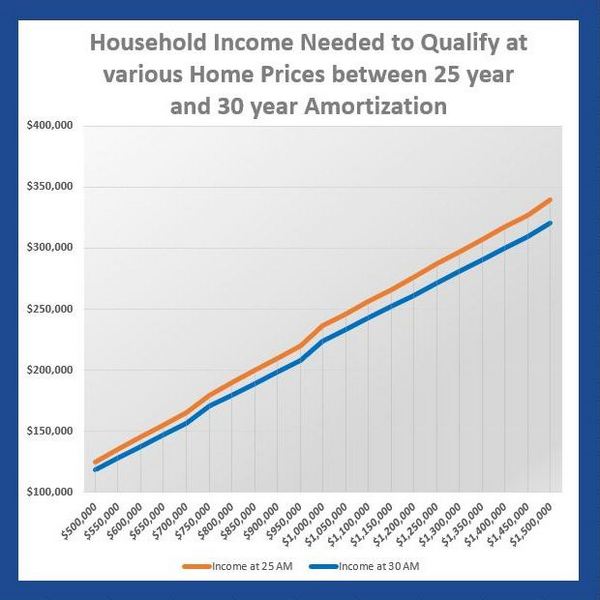

2) Qualify for a larger mortgage: Keeping monthly payments the same as a 25-year amortization allows buyers to qualify for a larger mortgage:

For example: At a home price of $500,000 you will need an extra $7000/year in income to qualify at 25-year amortization than 30-year amortization. For a $1,500,000 home, the difference is $19,000/year.

Raising the Insured Mortgage Price Cap

The increase in the price cap for insured mortgages from $1 million to $1.5 million is designed to help more buyers, but its effect may be more limited than you think.

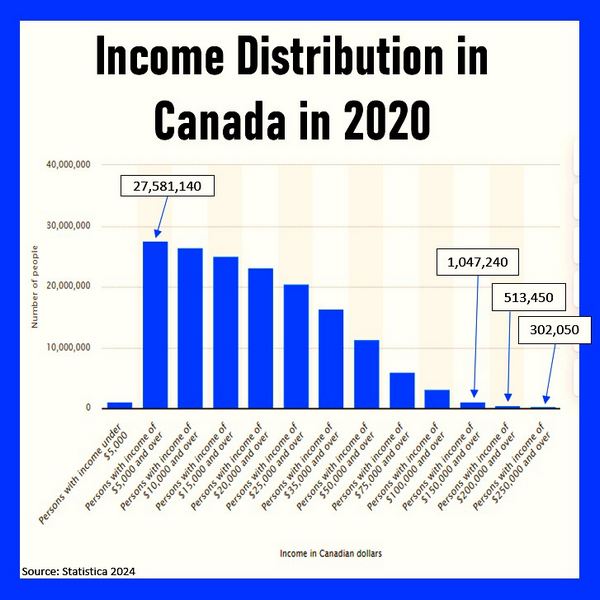

To afford a $1 million home with the minimum down payment, a household would need an income of around $217,000. For a $1.5 million home, that requirement jumps to $321,000—and even more if you’re buying a condo due to the condo fee.

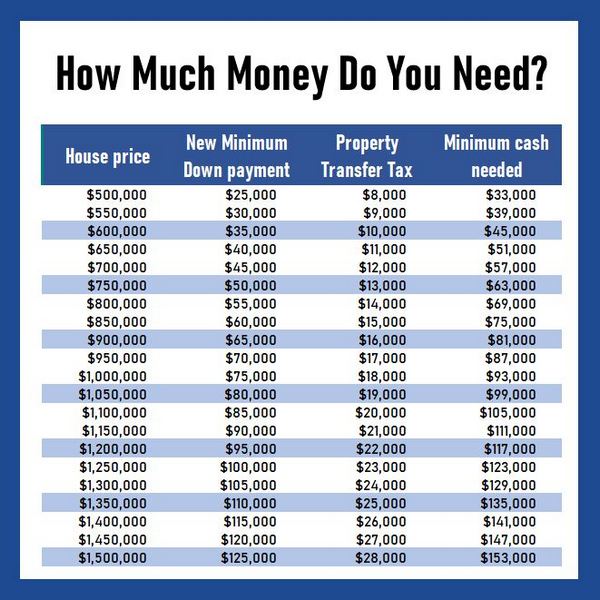

While the income hurdle is steep, the new rules could benefit those who have the income but struggle to save for a large down payment. Previously, buying a $1.1 million home required a down payment of $220,000. With the new rule, the same home now requires only $105,000, a significant difference for many buyers.

Still, when we look at the median household income in cities like Vancouver—around $117,300—it’s clear that many potential first-time buyers won’t meet the income requirements to take full advantage of these changes. I have included a table for the amount of money required to buy a home at various prices based on the new regulation.

Will This Spark a Market Surge?

Even though the number of people who can truly benefit from these reforms is limited, the changes could still create momentum, especially in markets where home prices hover around the $1.1 million to $1.2 million range. This might be enough to spark a strong spring market in 2025 as buyers rush to take advantage of the new rules along with the lower rates.