There are 3 recent changes to incentive programs that aims to make housing accessible to more people. The First-Time Home Buyer Incentive (FTHBI) program which was introduced in 2019 has been quietly discontinued. The last submission will be March 21st of this year.

The program was meant to help first time home buyers who are looking to reduce their monthly payment by having the government chip in for 5% to 10% of the purchase price. The problem is that the government will then share in the appreciation of your property, Another problem is that under this program you qualify for a smaller mortgage. So you are left with a very small and specific group that this program will make sense for. Few are going to miss this program.

The change to BC’s Property Transfer Tax (PTT) exemption will make more of an impact. Property transfer tax has to be paid on most transaction where the name on the title changes. 1.0% is paid on the first 200K. Then the amount up to 2M is taxed at 2%. From 2M to 3M, it is 3%. And for any amount above 3M, it is taxed at 5%. First time home buyers are eligible for a rebate on the PTT. Previously, the fair market value of the property must be $500,000 or less to get the full exemption. That is, no PTT has to be paid. Now it is $835,000. Past $835,000 you will get a partial rebate. And by $860,000 the rebate will be reduced to zero. The $500,000 was a little low for the Lower Mainland. Now at $835,000, more people can take advantage of this. And the savings is substantial. The PTT for a $835,000 property would be $14,700 otherwise! Also previously the first time home buyers are exempt from PPT for the purchase of brand new construction of up to $750,000. Now it will be 1.1M and at 1.15M the exemption will be completely phased out. This is a savings of $20,000!

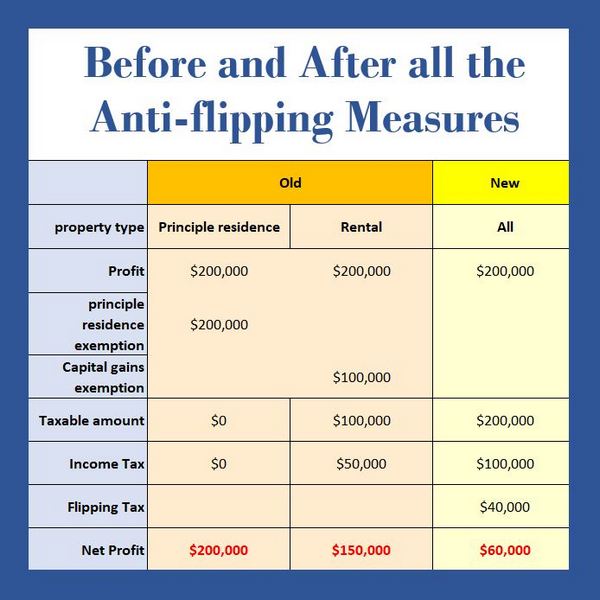

And finally starting 2025, there will be a BC Home Flipping Tax (HFT) applied to the profit of properties sold within the first two years of purchase. The tax rate for the first year is 20% and slowly decreases till it is zero at the end of year two. This also applies to the assignment of contracts. The intent is to discourage flipping. Note in 2022 the Federal Government introduced a set of rules that require the profits of the sale of a property sold within 12 months be treated as income. You cannot claim principal residence capital gain exemption or capital gain exemption for a rental property. The table below aims to clarify the impact through an example where a property was sold within 12 months for a profit of $200,000. A simplification of a 50% tax bracket is used. However, it is conceivable to get to this tax bracket if you are fully employed and flip houses on the side.

The landscape of housing incentives and taxes is ever changing. It is important to consult with a real estate professional when you want to start your journey into the real estate market.