One term that you might be hearing in the media in regards to mortgages that you never came across before is “trigger rate”. If you have a fixed rate mortgage, this will not affect you. If you have a variable rate mortgage that has payments that move along with the changes in the prime rate, this will also not affect you. However, if your variable rate mortgage payments do not change with the movement in the prime rate, then read on.

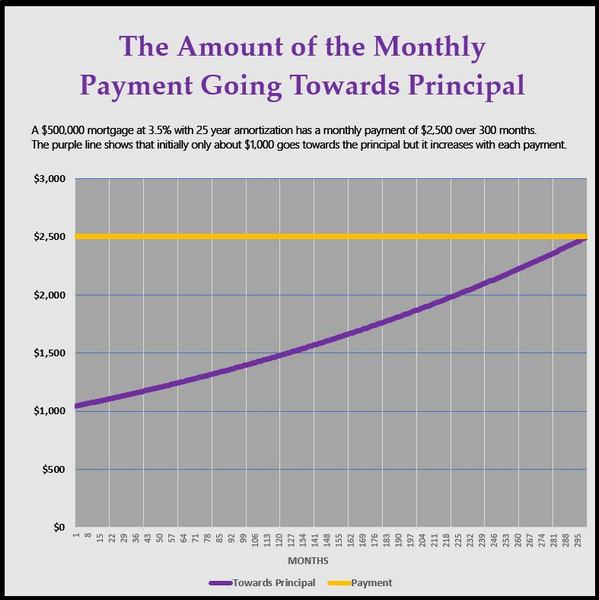

When a lender produces a payment schedule for your mortgage, they base it on the amortization. That is, how many years at a fixed payment will the mortgage be completely paid off at 25 years or 30 years. In the beginning of the mortgage, you owe the lender the full amount of your mortgage, but with each mortgage payment, you owe the lender less because a portion of the monthly payment goes towards paying the principal. Because you owe more in the beginning, there will be more interests to pay in the beginning within each payment. However, as the amount owing decreases, the amount of interest that needs to be paid falls. Because the payments are fixed, as the amount of interest that needs to be paid falls, the amount going towards the principals increases. As time passes, the principal gets paid down and less interest is charged and more of the payment goes towards the principal, until at the end when almost all of the payment goes toward the principal. Because typically, a term is 5 years; that is, after 5 years, the rate is renegotiated, this schedule is recalculated with the new rate when you renew your mortgage.

When interest rate rises for a variable rate mortgage, the amount of interest per payment increases. But if the payment is forced to stay the same, more of the payment will go towards the interest and less towards the principal. In effect, you are lengthening the amortization; that is, it will take longer to pay off your mortgage. If the rate continues to increase, the amount of interest per payment will continue to increase. Theoretically there will be a rate so high that the interest needed exceeds the fixed payment. That rate is the trigger rate.

When that happens, your lender will contact you to make arrangements to ensure the payment will cover the interest. Various things can be done. Typically, it would be an increase in the monthly payment. You can also increase the amortization or pay a lump sum. As long as you have a clean payment record, your lender will work with you.

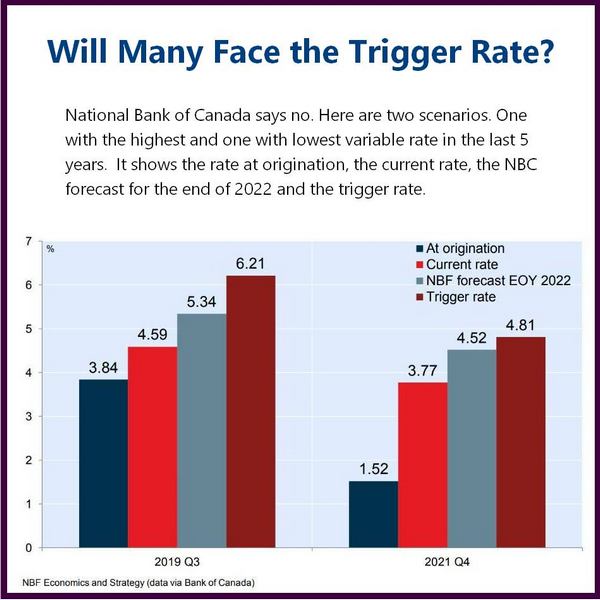

Recently, the National Bank of Canada economist ran some scenarios and concluded that most will not reach that point. He took the highest and lowest variable rate in the last 5 years and ran it in their model assuming an overnight rate of 3.25%. It is currently at 2.50%. With the higher rate of 3.84% in 2019 3rd quarter, the trigger rate is 6.21%. And for people who got a mortgage at 1.52% in the 4th quarter of 2021, the trigger rate would be 4.81%.The actual number will vary depending on individual conditions and the best thing to do if you are worried is to dig up your mortgage document because the trigger rate will be stated there. You can also proactively contact your lender to increase your monthly payment.