In certain situations, getting a reverse mortgage to help your adult children buy a home makes sense. Let’s look at a case study to see how this works.

Imagine an elderly couple who have lived in their family home for many years.

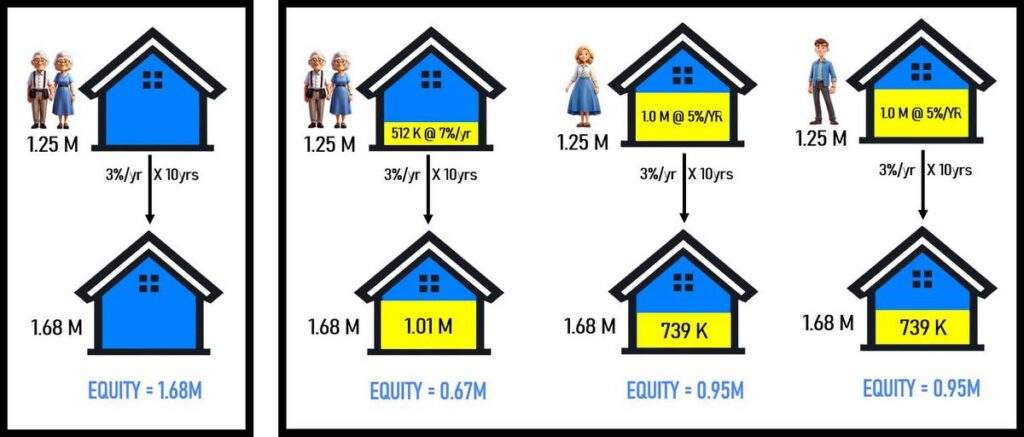

They don’t want to move, and their home, valued at $1.25 million in the lower mainland, is fully paid off. If the home’s value appreciates by 3% annually, in 10 years, it would be worth $1.68 million. If they passed away then, their two kids would each inherit $840,000. That’s a substantial down payment, but by that time, the children would be 45 and 48 years old.

Now, what if the parents took out a reverse mortgage at 7% so their children could get a down payment now? They could qualify for $512,500. If each child receives $250,000, they could use it as a 20% down payment to buy homes worth $1.25 million each, matching the value of the parents’ home.

After 10 years, assuming the homes appreciate at 3% annually, all three properties would be worth $1.68 million each. If the children have a 5% mortgage, the equity (the property’s value minus the mortgage loan) in each child’s home would be $947,000. The parents’ home, assuming no interest payments were made on the reverse mortgage, would have $670,000 in equity. So, each child would effectively inherit $335,000, but they would have lived in and built significant equity in their own homes for 10 years.

This scenario shows that, despite the higher interest cost, a reverse mortgage can be beneficial. However, every situation is unique, and it’s essential to do the math for your circumstances. Reverse mortgages carry higher interest rates and aren’t suitable for everyone. A home equity line of credit (HELOC) might be an alternative, but be aware that some lenders require a surviving spouse to qualify if one party dies, which might not be feasible if the intent is for the surviving spouse to remain in the home.

If you want to explore various scenarios and see what works best for you, feel free to contact me. I can help you navigate the options and make an informed decision.